2024Annual Report

Navigate the Future of Venture Capital:

Essential Intelligence for Founders, Investors, and Innovators

Top VC Fundraising Trends of 2024

A look-back at the venture capital landscape, 10 trends in VC investing, and the industries VCs are funding in 2024.

Venture Capital Landscape in 2024: A Brief Overview

2024 was a pivotal year for venture capital, marked by both turbulence and transformation. With 11.1% of funds shutting down and exits hitting a 14-year low, the industry faced growing skepticism about its sustainability. Yet, this contraction forced a shift toward discipline, shedding inefficiencies and paving the way for a more strategic and selective approach.

Unicorn churn defined much of the year, with the global count reaching 1,241, valued at $3.2 trillion. While 30-40 unicorns exited via down-rounds or closures, 180-220 new unicorns emerged, led by AI, fintech, and health tech. Capital efficiency took center stage, as investors prioritized strong fundamentals and ensured every dollar counted.

Brand power reigned supreme, with 20 funds raising 50% of all VC capital, showcasing the dominance of reputation over differentiation. Meanwhile, tech giants like Microsoft and Google focused their $370 billion cash reserves on infrastructure, leaving mid-market players to drive M&A activity. Data-centric investments surged, with spending on data centers exceeding $125 billion and stablecoins seeing a 50% rise in supply, reaching $300 billion.Emerging Investment Hotspots.

Key Trends Shaping the VC Landscape

The most prominent trend is the rise of artificial intelligence, with investors closely examining AI startups that offer scalable business models and practical applications. This comes alongside a growing emphasis on socially responsible ventures, where environmental, social, and governance (ESG) criteria play a crucial role in investment decisions.

Women founders are gaining significant momentum, with increased funding opportunities and a concerted effort to close historical funding gaps. This trend is supported by expanding networks and growing support for women in STEM fields.

Emerging Investment Hotspots

While Silicon Valley remained dominant, cities like Austin, Miami, Mexico City, and Singapore gained prominence. Globally, regions like Southeast Asia, the Middle East, and Latin America emerged as key players, alongside established hubs like London, Tel Aviv, and Bangalore, reflecting a more globalized venture capital landscape.

Industry Focus

Investors are showing particular interest in several key sectors:

- Generative AI driving enterprise tools, natural language processing, and autonomous systems

- Health tech advancing gene therapy, digital health platforms, and diagnostics

- Cybersecurity focusing on zero-trust architectures and AI-powered threat detection

- Agri-tech innovating vertical farming, sustainable agriculture, and food security

- Sustainable energy targeting scalable battery technologies and carbon capture

- Data and infrastructure enabling advanced GPUs and next-gen architectures for AI workloads

VC Insights: Straight Talk for Family Offices

Tired of chasing VC opportunities in the dark? We're building a community where LPs, HNWI, family offices can:

- Share real investment experiences

- Compare notes on fund managers

- Cut through the startup hype

- Learn from each other's successes and failures

No sales pitch. Just honest conversations about venture capital.

📆 Interested in connecting? Let's talk.

Smart Filtering

Easily filter funds by stage, sector, startups, NPS, geography, and check size to find the perfect match for your startup.

Precise Links

Access the best ways to connect with each fund, LP and Family Office saving you valuable time and effort.

Integrated Data

Our platform seamlessly integrates data from various sources, ensuring the most accurate information is available for informed decision-making.

Knowledge Hub

Explore our community for the latest papers, trends, and insights, including private data and updated easy-to-understand summaries.

+500

New LPs every month

+1.3 million

Data points

+$7 billion

Assets under management

Fund Activity Overview

- Active Funds:Funds that have made investments in the last 2 years

- Inactive Funds:Funds that haven't made investments in the last 2 years

How many funds are active, and where are the inactive ones concentrated?

Active Funds:

89% of the funds in our database are active. These funds have made recent investments and continue to participate in the VC landscape.

Inactive Funds:

11% of the funds are inactive. These funds have not made any investments within the past 2 years and are considered dormant.

Concentration of Inactive Funds:

Inactive funds are primarily concentrated in North America and Europe, reflecting a potential trend where funds in these regions are either in between investment cycles or are facing strategic delays.

Active vs. Inactive Funds Breakdown

Sector Insights – Active vs. Inactive

The AI sector leads active funds with 40%, followed by FinTech and Healthcare. Meanwhile, Blockchain and Traditional Retail dominate inactive funds, highlighting challenges in these areas.

Leading Sectors in Active Funds

Leading Sectors in Inactive Funds

2024 Private Equity Pulse

Navigating Valuations, Profit Priorities, and Market Resilience

Change in Investor 2023-2024 By Fund

Valuations & Activity

Lower valuations in 2023 persist into early 2024. Growth equity funds show resilience, while venture funds face steeper declines.

Profitability vs. Growth

A shift from growth to profitability is evident in buyouts, where investors increasingly focus on profits.

Health IT

The Health IT sector has attracted high funds, driven by the sectors potential for innovation and scalability.

Market & Election Outlook

Future markets remain strong despite IPO slowdowns. A rising emphasis on innovation for private equity and healthcare.

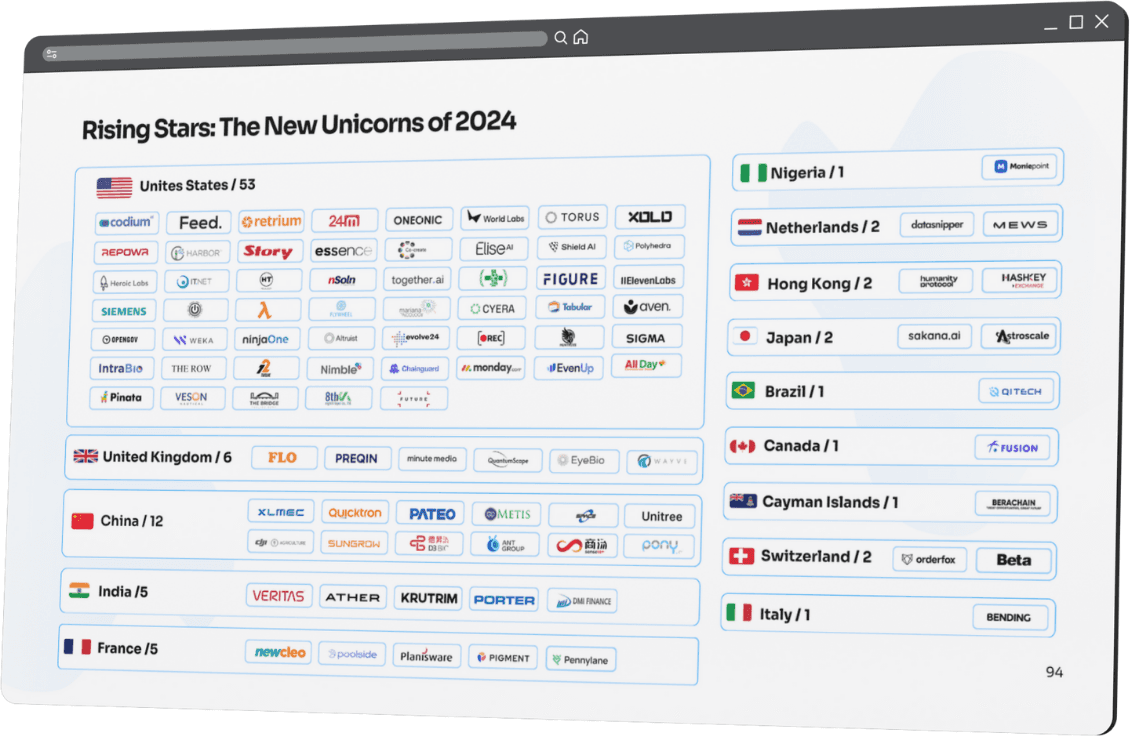

The New Unicorns of 2024

25 Emerging VC Firms of 2024

TOP 25 Business angels of 2024

TOP 25 VC Firms of 2024

Andreessen Horowitz (a16z)

Menlo Park, California

In recent years, Limited Partners (LPs) have significantly shifted how they allocate capital to venture capital (VC), with family offices, sovereign wealth funds, institutional investors, corporate LPs, and university endowments playing pivotal roles.

KEY TRENDS IN VENTURE CAPITAL INVESTMENT

Family Offices and Sovereign Wealth Funds:

Family offices and SWFs are leading the charge in new commitments to VC, significantly funding innovation-heavy sectors like artificial intelligence (AI) and biotechnology. Notable players such as Singapore's GIC and Abu Dhabi's Mubadala are driving this trend. GIC invested $1.9 billion in European startups in 2024, while Mubadala became the world's most active sovereign wealth fund, committing $29.2 billion across 52 deals—a 67% increase from 2023.

Family offices are also deepening their engagement with VC funds, recognizing the potential for high returns and diversification in their investment portfolios. They are increasingly adopting strategies similar to those of SWFs, focusing on long-term wealth preservation and sustainable investments.

Institutional Investors:

Institutional investors, including pension funds and insurance companies, are stepping up their involvement in VC. Pension funds, for the first time in five years, outpaced SWFs in co-investment activity during 2024. These investors are particularly drawn to sectors like fintech, clean technology, and AI, which offer strong long-term growth potential. This resurgence reflects a broader trend of institutional investors seeking higher returns in a low-yield environment, though some are delaying hedge fund investments, signaling strategic shifts.

Corporate Limited Partners:

Major corporations are utilizing venture capital to drive strategic growth and align investments with business objectives. Companies like Amazon and Microsoft have established venture arms to invest in emerging technologies such as generative AI. Microsoft announced an $80 billion AI investment plan for 2025, while Nvidia significantly increased its participation in AI funding rounds. Additionally, Intel plans to spin off Intel Capital into a standalone company in 2025, marking a strategic shift in corporate venture investments. Collaborations like MetLife and General Atlantic’s Chariot Reinsurance, set to launch this year.

Such strategic investments not only provide financial returns but also support innovation that can drive future business growth.

University Endowments and Foundations:

University endowments in the United States are increasing their allocations to VC, drawn by the prospect of outsized returns despite inherent risks. In fiscal year 2024, many institutions posted returns exceeding 12%, with the University of California San Diego Foundation achieving a great 15.5% This trend underscores a growing recognition among educational institutions of the value of engaging with the venture capital ecosystem to balance traditional investments with innovative opportunities.

Conclusion

The venture capital landscape in 2025 is increasingly influenced by diverse LPs committing substantial capital to drive innovation across various sectors. Family offices and sovereign wealth funds remain at the forefront, leveraging long-term investment horizons to tap into high-growth areas like AI and biotechnology. Institutional investors are enhancing their engagement with VC, while corporate LPs align strategic investments with business goals, particularly in emerging technologies. University endowments are balancing traditional approaches with high-reward opportunities. As these trends continue to evolve, they will shape the future of venture capital, highlighting the importance of collaboration among investors to foster sustainable growth and innovation in an ever-changing market environment.

Do not Miss Out on the Complete Report!

Get exclusive access to our comprehensive analysis and insights.