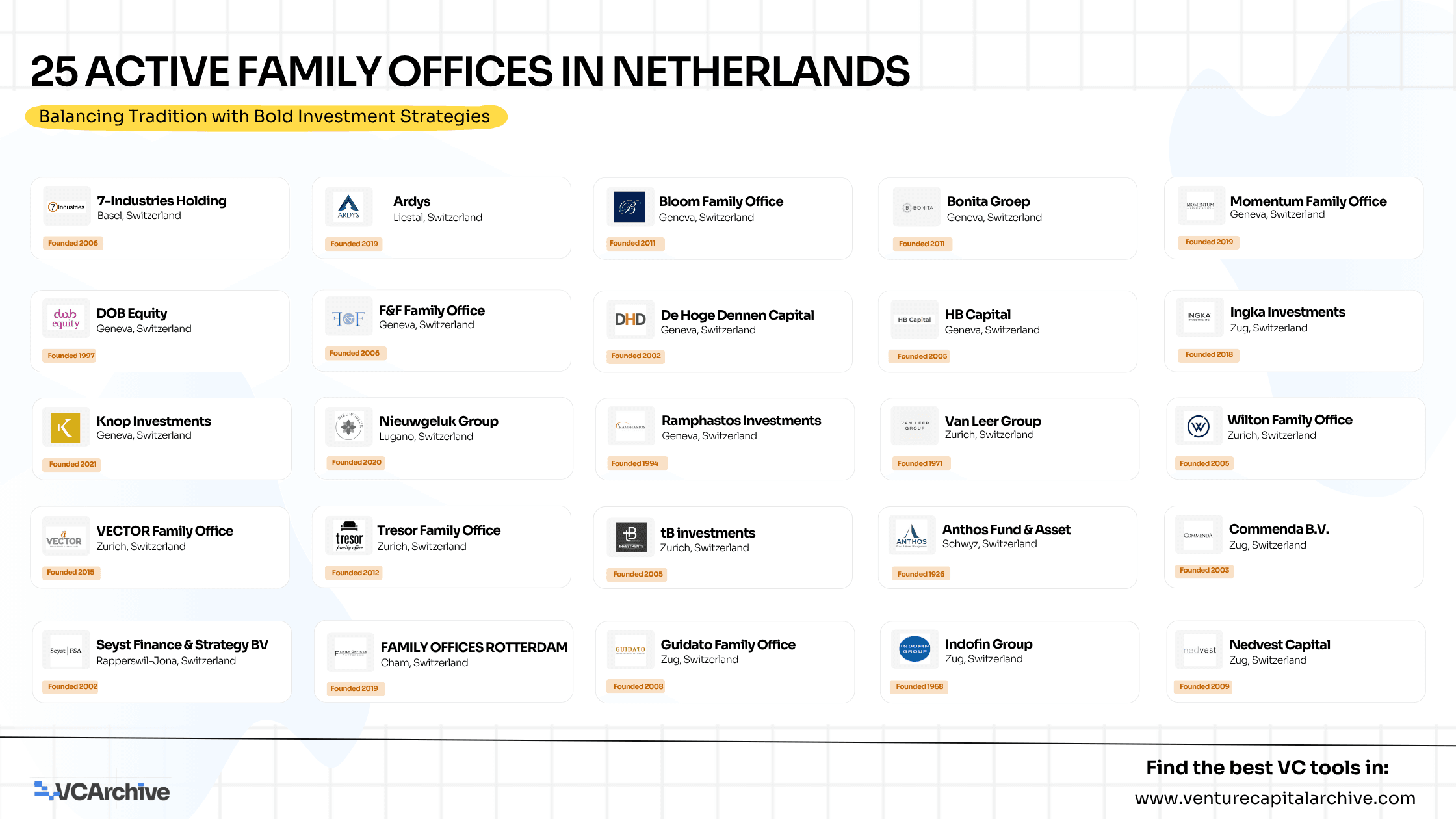

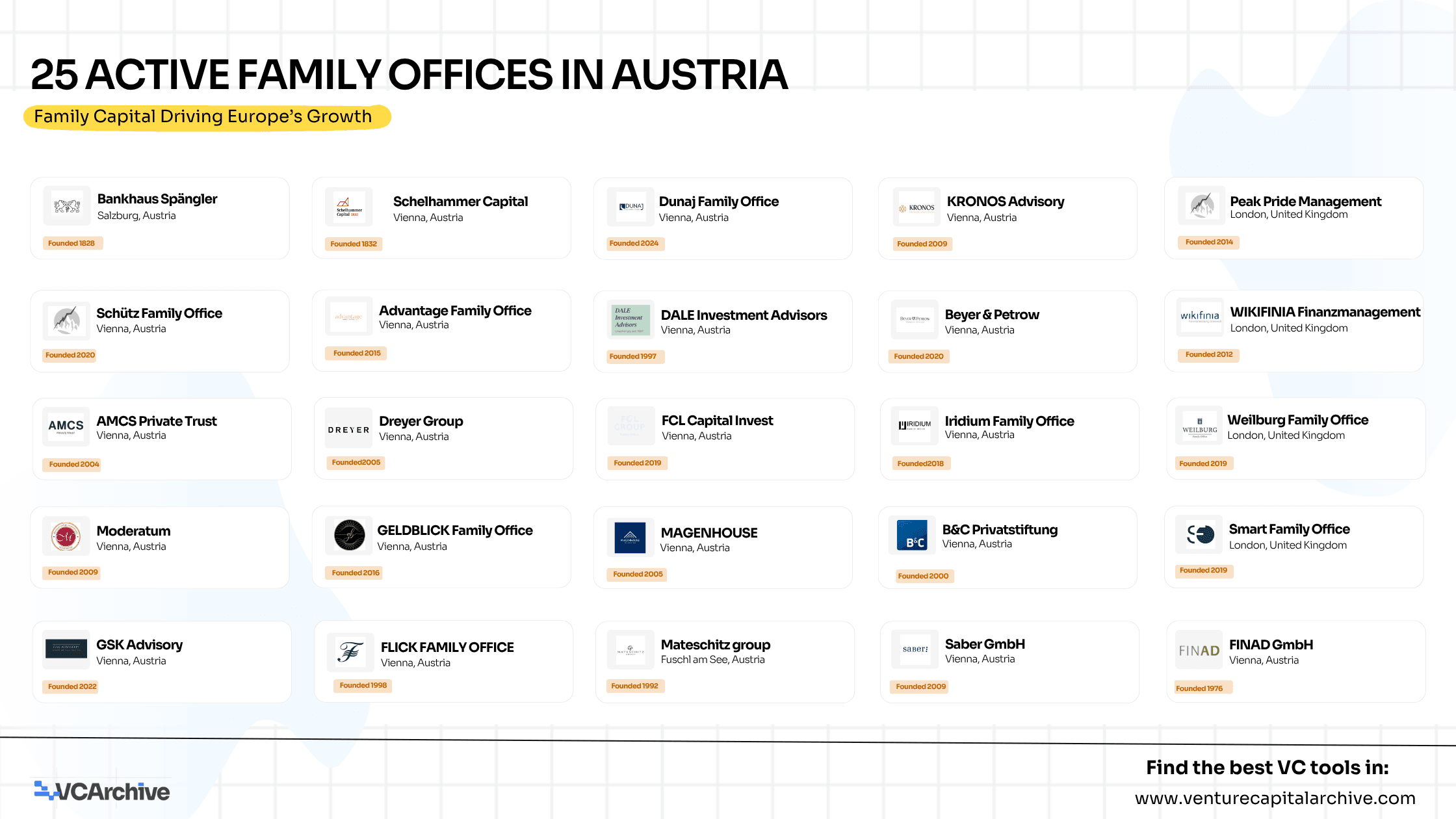

25 Active Family Offices in Austria

Austria stands at the crossroads of European private capital, a country where centuries-old family legacies intersect with modern investment ambition. From Salzburg’s heritage banks to Vienna’s discreet multi-family offices, Austria’s family offices are redefining what it means to combine tradition with transformation.

Dario Villena

Director