Find the investors

others miss

Access 40,000+ family offices and LPs that don't show up in Crunchbase. Get weekly intelligence on where capital is actually moving.

See pricing and features instantly. No credit card required.

Used by founders backed by

The Reality of Fundraising

You're pitching the same 50 VCs as everyone else

Limited Visibility

You only know the VCs that make headlines. Meanwhile, 40,000+ family offices and LPs are writing checks quietly—but you don't know who they are.

Outdated Information

You're working from stale databases and recycled LinkedIn lists. By the time you reach out, the opportunity is gone.

Wrong Targets

You waste months pitching investors who aren't deploying, don't match your stage, or already closed their allocation.

Everything You Need in One Place

The complete private capital intelligence platform

Stop guessing. Start knowing who's investing, where money is moving, and how to reach the right capital sources for your round.

40,000+ Capital Sources

Family offices & LPs

Real-Time Intelligence

Weekly updates

Active Investors Only

Currently deploying

Venture Capitals

Find active VCs actually deploying capital

Stop wasting time on cold emails to investors who aren't writing checks. Our database shows you who's actively investing in your category, right now.

Benefits:

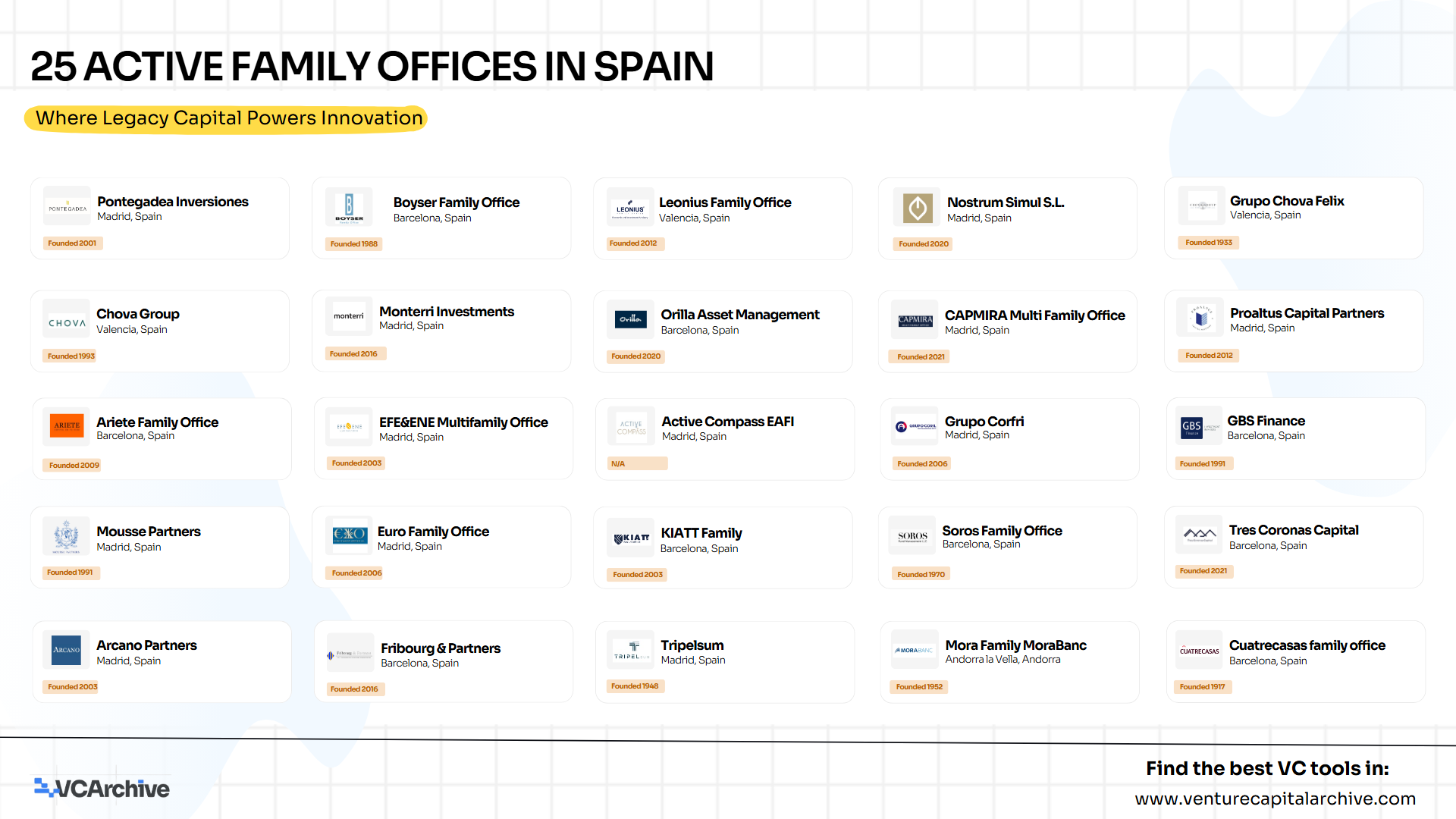

Limited Partners

Access 40,000+ capital sources you've never heard of

The best money doesn't make announcements. Family offices, direct LPs, and private investors move billions quietly—now you can find them.

Benefits:

Archives

Every template, deck, and resource to close your round

Stop reinventing the wheel. Access battle-tested fundraising materials, legal templates, and successful pitch decks from funded companies.

Benefits:

Insights

Know where venture capital is moving

Weekly, data-backed intelligence on venture capital — new funds, major rounds, exits, and the capital flows shaping what comes next.

Inside Insights:

Choose Your Plan

Get the intelligence edge for your fundraise

All plans include our private weekly intelligence newsletter. Start with what fits your timeline, upgrade anytime.

Sprint

6 months

Compare All Features

See exactly what you get

| Feature | Sprint | Annual Pro | Lifetime Elite |

|---|---|---|---|

| ACCESS | |||

| Access Duration | 6 months | 12 months | Forever |

| CORE PLATFORM | |||

| VC Database (15,000+ firms) | |||

| Private Weekly Intelligence | |||

| Real-time Updates | |||

| Pitch Deck Upload | |||

| AI Investor Matching | |||

| SILENT MONEY ACCESS | |||

| LP & Family Office Database | 40,000+ | 40,000+ | |

| Quarterly Enrichment | Lifetime | ||

| Direct LP Community | |||

| RESOURCES & TEMPLATES | |||

| Archive Access | Basic | Full | Full |

| Pitch Deck Downloads | 10 | 50+ | All |

| Legal Templates | |||

| Financial Models | |||

| Custom Research Requests | 2/year | ||

| TOOLS & FEATURES | |||

| Advanced Search & Filters | Basic | ||

| Export Capabilities | |||

| Early Beta Access | |||

| All Future Products | |||

| SUPPORT & COMMUNITY | |||

| Founder Community | |||

| Email Support | 72hr | 48hr | Same day |

| Strategy Calls | Quarterly (1h) | On-demand | |

| Annual Online Summit | |||

| LP Events | |||

| Warm Intro Facilitation | |||

Why act now?

Our database grows more valuable every quarter. We add 200-300 new family offices and LPs each enrichment cycle. Annual and Lifetime members get these additions automatically.

Lifetime Elite is limited to 500 founding members. Once we hit capacity, we close it permanently to preserve community quality.

Current Status

152/500

Lifetime Elite spots remaining

70% filled

152 spots left

FAQs

FAQ about our platform.

Those platforms show you public funding data after it happens. We show you family offices and LPs that don't announce deals, who's actively deploying capital right now, and intelligence before it becomes news. Our LP database has 40,000+ sources you won't find anywhere else.

Yes. You can pay for a Sprint access. If you don't find value, don't pay the next month.

You can upgrade to Annual Pro ($399) or Lifetime Elite ($999), and we'll credit your $199. Or let it expire and keep receiving the free weekly newsletter.

The VC database updates weekly. The LP/Family Office database (Annual/Lifetime only) gets major enrichment monthly (200-300 new sources) with continuous minor updates.

A private network where you can connect directly with LPs, family office principals, and other elite members. Think of it as a vetted network of capital allocators and successful founders. Includes private community, quarterly virtual events, and annual in-person summit.

Absolutely. You can upgrade anytime and we'll credit what you've already paid toward the higher tier.

Both. Founders use it to find capital. GPs and investors use it to track competition, find co-investors, and stay on top of market intelligence. About 80% founders, 20% investors.

If you're planning to raise in the next 12 months, Annual Pro makes sense for preparation. If you're not planning to raise anytime soon, start with our free weekly newsletter until you need the full platform.

Years of relationship-building, Kauffman Fellows network access, direct outreach, and proprietary research. This isn't web scraping—it's actual relationship mapping.

Yes. All payments processed through Stripe with bank-level encryption. We never see or store your payment information.

Still have questions? Email us at [email protected]

Who Built This

Why this exists (and why it matters to you)

Hi, I'm Darío Villena — founder of Venture Capital Archive.

I spent a decade as a capital allocator in top-tier VCs and family offices, building the internal intelligence systems that tracked where billions were actually moving.

Here's what I learned: Founders were pitching blind while insiders operated with perfect information. The information asymmetry wasn't fair. It wasn't about building better companies. It was about knowing the right people. So I built what I wish existed when I was on the other side.

Venture Capital Archive aggregates 40+ sources into weekly intelligence briefs:

- Fresh fund closes (and who needs to deploy now)

- First-time managers and family offices entering the market

- LP movements and sector pivots as they happen

The same intelligence layer I built internally, now accessible to everyone. Not Crunchbase. Not public lists. Real-time signals on who had fresh powder, who was under pressure to deploy, which new players were entering the market.

A note on our community

Started as my Kauffman Fellows final project. Now trusted by 800+ founders and investors who believe in using intelligence strategically. Our community values quality outreach over volume—we're building the intelligence layer for professionals who respect the ecosystem. If that's you, welcome.